If you are ten or more years away from retirement and find yourself consumed with thoughts of the market’s volatility, this is for you.

Read MoreMost employers have moved away from the traditional pension plan in favor of employee-self-funded 401K’s, 403B’s, and other retirement plans. If you’re one of the lucky few still holding a pension, here are a few tips to help you decide on the best payout option for you.

Read MoreAt CURO, we look at Earth Day differently. In the hopes of inspiring you, here are a few of the habits we regularly practice both in and out of the office.

Read MoreAn ode to the women who inspire us. May we know them, may we be them, and may we honor them in all that we are.

Read MoreChoosing to divorce is difficult and leaves one feeling uncertain about the future. We asked Marianna the most common questions about divorce, and she offered her wisdom:

Read MoreEvery year, when mashed potato season begins and swimsuit season ends, I like to take inventory of all of the things I’m grateful for in my life with a list, tis’ the season after all…

Read MoreMost people who are newly widowed or divorced, will update their employer retirement account beneficiaries to their children. Logically, your chosen beneficiaries should receive the percentage of your account that you indicated, but people who remarry should be wary of accidentally disinheriting their own children from their 401(k)s.

Read MoreInsurance is at the bottom of the list of things we want to think about because it's complicated and confusing to many people, but it’s necessary to protect ourselves and our family members from financial disasters.

Read MoreIn March of 2020, Federal student loan borrowers were given a break from having to make their student loan payments, with interest rates frozen at 0%. Unfortunately, our break from student loan payments and interest accumulation must come to an end and is set to sunset on January 31, 2022.

Read MoreWhen a couple is divorced, or a spouse passes away, life changes rapidly. These situations force a complete turnaround of how you manage and view your finances. If you are someone experiencing a divorce or are mourning the loss of your partner, read on to learn about the first three proactive steps you can take to ensure your financial security.

Read MoreA financial plan can help you to unlock different levels of your life. By mapping out your current lifestyle including your spending habits, debt control, and personal attitude toward finances and money management, we can help you to take control of your future and feel confident in your actions.

Read MoreOn April 28, 2021, the White House released a fact sheet for President Biden's American Families Plan (AFP). Major provisions proposed in the plan are summarized here, including some tax provisions.

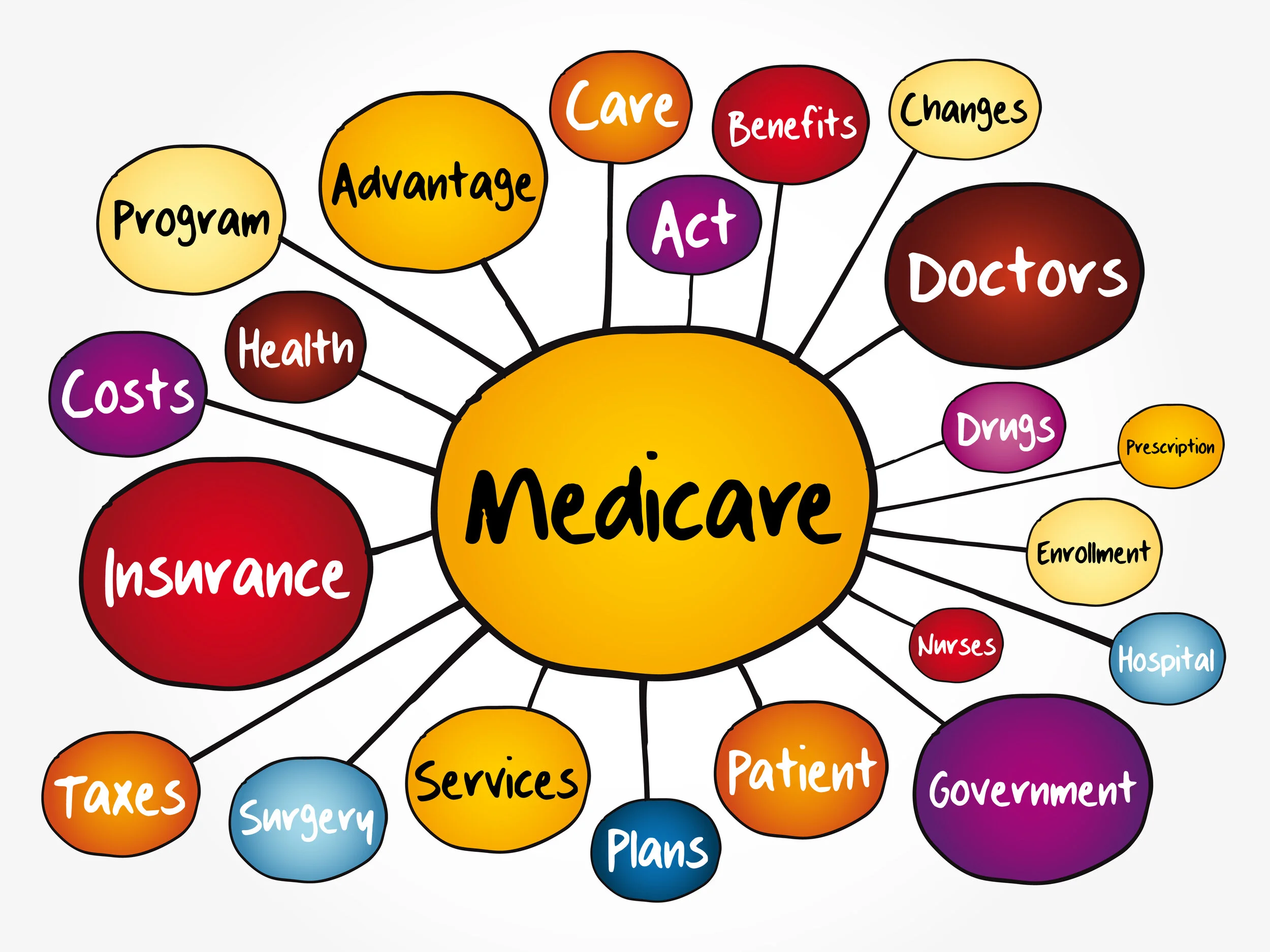

Read MoreAs a follow-up to our latest Medicare webinar series, we thought it would be beneficial to share 11 of the costly mistakes that you can avoid making when enrolling and choosing your Medicare plan.

Read MoreOn Thursday, March 11, 2021, the American Rescue Plan Act of 2021 (ARPA 2021) was signed into law. Major relief provisions are summarized here, including some tax provisions.

Read MoreOver the course of 11 trading days from January 13 to January 28, 2021, the stock of GameStop, a struggling brick-and-mortar video game retailer, skyrocketed by more than 2,200%.

Read MoreWednesday, January 6, 2021, will be remembered in the history books—for a couple of reasons. First, while Congress met to count the inaugural votes, we anticipated that members from both houses would be objecting to electors from some states.

Read MoreBelow, we’ve compiled 20 lessons we learned in 2020 with the hope of inspiring you to find your very own moments of happiness as you reflect on this past year.

Read MoreI started as a Finance major in the Fox School of Business at Temple University in the Fall of 2017. In high school, I had taken a few business classes and found myself drawn to understanding personal finance and wanting to help people, without any desire of being an accountant.

Read MoreWe chose this line of work because we find purpose in helping others achieve their dreams and curate a wealthy life. Our firm's name is a reflection of the enduring connection we have with each of our clients.

Read More