JNJ RSUs Quick Reference Guide to Vesting

JNJ RSUs are vesting on February 13, 2020

My Restricted Stock Units (RSUs) just vested. What happens next?

Vested price is the price of JNJ stock on 02/13/2020.

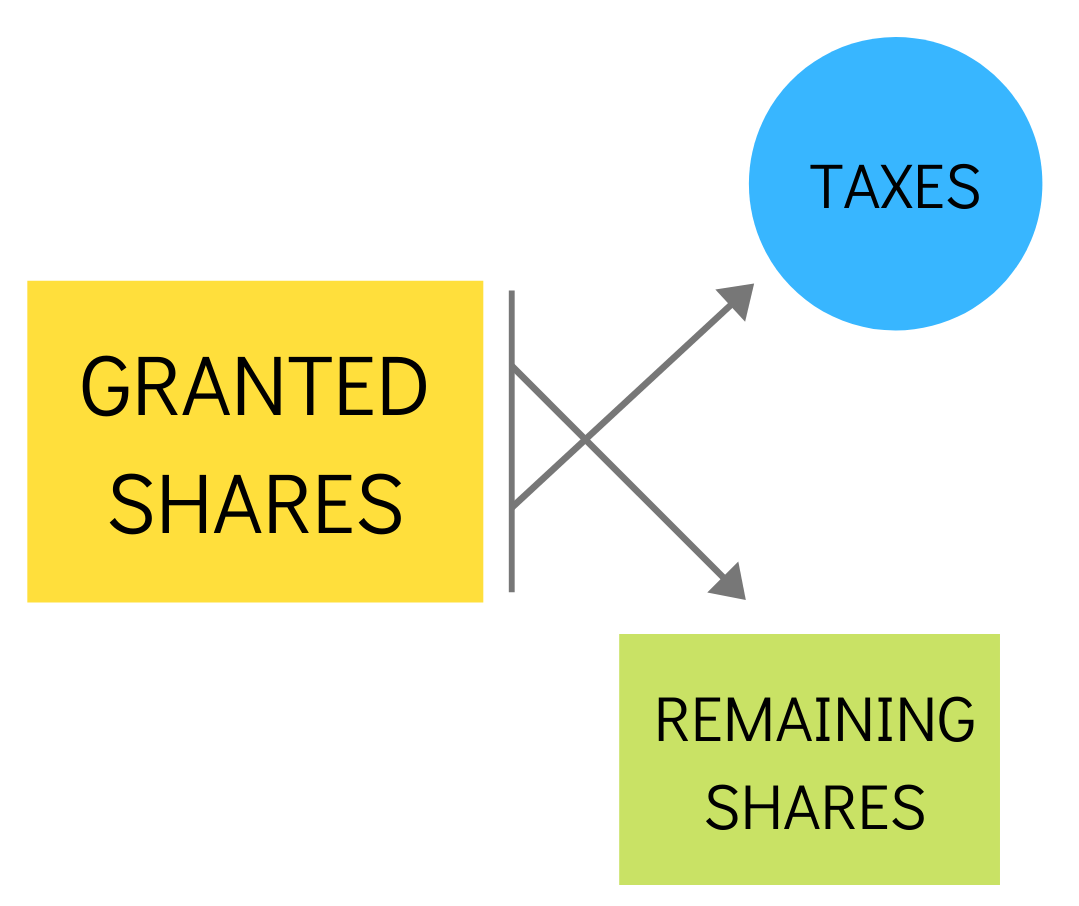

NET Shares (net of Federal, Social Security, Medicare, State and local taxes) are deposited into your Fidelity Brokerage account 2-3 business days after vesting.

You can SELL the remaining shares immediately and use proceeds to fit your overall financial plan

NO additional tax is due upon sale since Vested Amount (Number of shares x Stock price) will be added to your W-2 income and will show on your paycheck under a separate line item.

OR

You can KEEP the remaining shares and choose to sell them later

Additional tax is determined based on the difference between the vested value and the future sale price.

Depending on how long you keep the shares after they vest, you will either pay capital gain tax (10%, 15% or 20%) or regular income tax at the time of sale.

IMPORTANT: Your tax preparer will need your 12/31 paystub and 1099 statement from Fidelity to report accurate gain on sale

Should I sell now OR later? It all depends on your INDIVIDUAL answers to the questions below:

Do you own more shares of the JNJ stock in your 401k or individual account at Fidelity and/or Computershare?

Do you have more RSUs or Stock Options vesting in the future

Do you feel that your employer stock will go higher, and if so, would you buy more today?

What is your new tax bracket based on the 2018 Tax Law?

Did you consider the implications of the Secure Tax Act passed in December of 2019?

We can HELP. Give us a call so we can help you make the most of your benefits.